Lower the Cost of Governance to Rebuild Trust in Nigeria Tax Reform

Nigeria Tax Reform conversation is often reduced to a narrow argument about rates, levies, and who pays what. Yet, for millions of Nigerians—workers, entrepreneurs, professionals, investors, and public servants—the real issue goes far deeper. At its core, Nigeria Tax Reform is not just about tax rates; it is about governance, trust, and the country’s economic future.

Citizens are not resisting taxation because they are unwilling to contribute. They resist because the relationship between the government and the governed has broken down. People ask tough but legitimate questions: Why is the cost of governance so high when revenue is limited? Why do some states struggle while others perform better with similar resources? Why should citizens comply when outcomes feel disconnected from sacrifices?

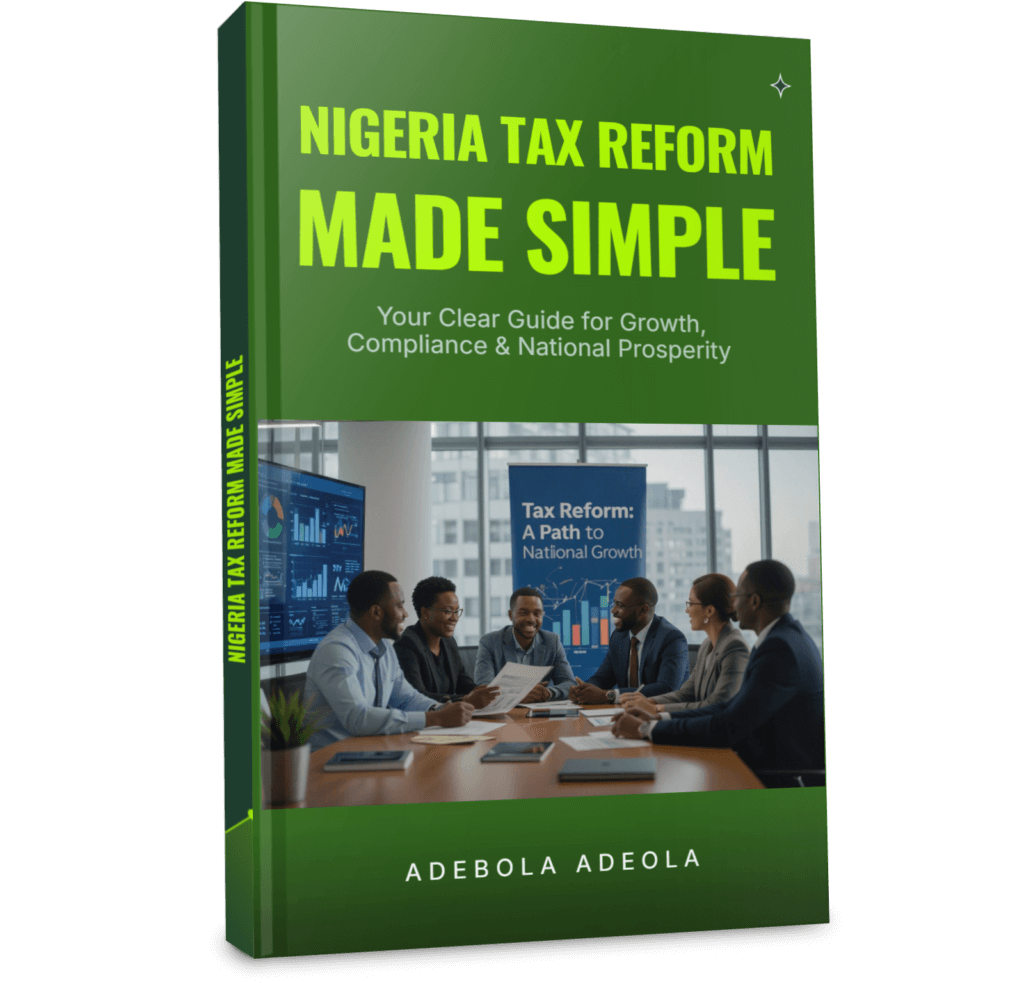

These questions form the foundation of Nigeria Tax Reform Made Simple, a book designed to move the national conversation beyond slogans and fear, into clarity, facts, and actionable reform.

Why Nigeria Tax Reform Cannot Be Reduced to Tax Rates

In many global economies, tax reform debates focus on efficiency and competitiveness. In Nigeria, the debate is emotional because it touches survival. Inflation, exchange rate instability, unemployment, and declining purchasing power mean that every additional naira demanded by the state feels personal.

However, focusing only on rates misses the real challenge. Nigeria Tax Reform is fundamentally about how revenue is raised, how it is spent, and whether citizens can see value for money.

When people feel taxed but not served, compliance drops. When trust erodes, enforcement becomes expensive and ineffective. When governance structures remain opaque, even well-designed tax laws struggle to gain legitimacy.

This is why tax reform cannot succeed without governance reform.

The Cost of Governance Question Nigerians Keep Asking

One of the most emotionally charged debates surrounding Nigeria Tax Reform is the cost of governance. Citizens want to know why a country with a low tax-to-GDP ratio maintains a governance structure that feels oversized and expensive.

Nigeria collects relatively little compared to the size of its economy, yet recurrent expenditure—salaries, allowances, overheads, and political structures—consumes a disproportionate share of revenue. This imbalance fuels resentment and weakens the moral authority of tax institutions.

High cost of governance sends a dangerous signal: that taxes fund bureaucracy rather than development. Until this perception is addressed head-on, Nigeria Tax Reform will continue to face resistance.

Tax-to-GDP Ratio: What the Gap Really Means

Nigeria’s tax-to-GDP ratio is among the lowest globally and in Africa. This gap is often cited as justification for aggressive tax drives. But Nigeria Tax Reform must ask a more nuanced question: Why is the ratio low in the first place?

Low ratios reflect:

- A narrow tax base

- A large informal economy

- Weak trust in public institutions

- Poor visibility of how taxes translate into public value

Raising rates without fixing these structural issues risks worsening inequality, shrinking SMEs, and pushing more economic activity underground.

Effective Nigeria Tax Reform should prioritize broadening the base, simplifying compliance, and restoring confidence, rather than overburdening already compliant taxpayers.

How States Compare on Tax Effort and Efficiency

A critical but often ignored part of Nigeria Tax Reform is state-level performance. States operate under similar constitutional frameworks, yet outcomes differ widely.

Some states demonstrate better tax effort, stronger internal revenue generation (IGR), and more disciplined spending. Others rely heavily on federal allocations while maintaining high governance costs.

Comparative analysis reveals that:

- Efficiency matters more than sheer tax pressure

- Transparency improves voluntary compliance

- Citizens respond positively when they see local impact

Nigeria Tax Reform must therefore encourage peer benchmarking, fiscal responsibility, and accountability at the subnational level, rather than blanket federal mandates.

Governance, Trust, and Compliance Are Interconnected

At the heart of Nigeria Tax Reform lies a simple truth: people comply when they trust.

Trust grows when:

- Tax rules are clear and predictable

- Government spending is visible and defensible

- Institutions communicate honestly

- Citizens feel respected, not threatened

When trust is absent, enforcement costs rise, disputes increase, and compliance becomes adversarial. No tax authority can audit or police an entire economy indefinitely.

That is why Nigeria Tax Reform must be built on transparency, communication, and fairness, not fear.

Transparency as the Missing Link

One of the bold ideas explored in Nigeria Tax Reform Made Simple is the establishment of a (National) or Nigeria Transparency & Accountability Framework.

Such a framework would:

- Show how much revenue is collected

- Reveal how funds are allocated across sectors

- Track project execution and outcomes

- Allow citizens to follow the money in real time

Transparency transforms taxation from a black box into a shared national project. It changes the narrative from “government taking” to “nation building together.”

For Nigeria Tax Reform to succeed, transparency must be institutionalized, not treated as a public relations exercise.

Global and African Lessons Nigeria Must Learn

Successful tax systems across the world share common traits:

- Moderate rates are applied broadly

- Efficient administration

- Strong public accountability

- Clear links between taxes and services

African peers that have improved tax performance did not start by raising rates aggressively. They focused on simplification, digitization, trust-building, and visible public benefits.

Nigeria Tax Reform can draw from these lessons, adapting them to local realities rather than copying models blindly.

SMEs, Jobs, and Growth: What’s at Stake

Small and medium-sized enterprises sit at the center of Nigeria’s economy. They create jobs, innovate, and sustain communities. Yet SMEs are often the most vulnerable during poorly designed reforms.

Nigeria Tax Reform must:

- Reduce compliance complexity

- Eliminate multiple taxation

- Provide certainty and predictability

- Reward formality rather than punish it

When SMEs thrive, employment grows, productivity improves, and revenue expands organically. This is the virtuous cycle Nigeria needs.

From Survival to Prosperity: Strategic Reform Choices

Nigeria stands at a crossroads. One path leads to survival-mode governance—high costs, low trust, weak compliance, and constant fiscal stress. The other leads to strategic reform—lean governance, transparency, trust, and sustainable growth.

Nigeria Tax Reform is the bridge between these two futures.

The choices made today will determine whether the country unlocks its potential or remains trapped in cycles of reform fatigue.

Inside Nigeria Tax Reform Made Simple

This book goes beyond theory to provide practical clarity on Nigeria Tax Reform. Inside, readers will find:

- A deep dive into the Cost of Governance Question

- Global and African benchmarks Nigeria must learn from

- A proposed Nigeria (or National) Transparency & Accountability Framework

- A bold Policy Memo addressed to President Bola Ahmed Tinubu, the Senate President, the Speaker of the House, the Chairman of the Governors’ Forum, and the Association of Local Governments of Nigeria (ALGON), outlining a realistic path to fiscal discipline and national renewal

This is not abstract economics. It is policy explained in plain language, designed for citizens, professionals, policymakers, and investors alike.

Why This Conversation Matters Now

Nigeria Tax Reform is happening in real time. Decisions made today will shape:

- The cost of living

- Business survival

- Investor confidence

- Public trust in government

- The country’s long-term development path

Silence and confusion are no longer options. Understanding is power.

Conclusion: Reform Begins With Clarity

Nigeria Tax Reform is bigger than tax rates. It is about how the nation governs itself, how it earns trust, and how it secures its future.

Countries do not grow because they tax more. They grow because citizens believe in the system, comply willingly, and see results.

If you care about growth, compliance, accountability, and Nigeria’s economic future, this conversation is for you.

📘 Take Action

👉 Grab your copy of Nigeria Tax Reform Made Simple

Read the details. Understand the reforms. Join the conversation shaping Nigeria’s next chapter.

Buy now. Read with clarity. Engage with confidence.

Published by Mr. Adebola Adeola CEO Dinet Comms, Founder of PR CompaiPA, A Financial Public Relations Agency.